ISJ Exclusive: Managing video in financial institutions

James Thorpe

Share this content

The financial industry has undergone a significant transformation over the last five to ten years, as the digital revolution and development of advanced technologies have propelled the market forward when it comes to innovation, convenience and enhancing customer satisfaction. An increase in mobility and interconnectivity has allowed banks and credit unions to offer customers instantaneous service and support while ensuring comprehensive protection of their facilities through the latest security solutions.

However, the financial market will unfortunately always be one that stands out as a target to bad actors and as technology becomes more complex and sophisticated, so too do criminals. We’re seeing this trend even more so now that the financial industry is experiencing a level of convergence never before seen, as cyber and physical security components are merging across the board. Banks must still contend with risks such as robberies and active shooter threats, but cyber elements such as fraud and data breaches must also be top-of-mind in today’s connected world.

With this complicated and evolving risk landscape becoming more prominent every day, one fact has become abundantly clear when it comes to threat mitigation: time is of the essence. The security challenges banks must contend with on a daily basis can be overwhelming, but prompt action is necessary to limit the damage that can greatly affect customers, employees and the brand. When an incident occurs, investigators must be able to swiftly locate and analyse all pieces of information required to determine the proper resolution.

It is therefore critical for financial organisations to leverage innovative security tools and processes that allow them to gather the insight needed to close investigations faster and more efficiently. These solutions must not be complex to use and manage; banks and credit unions need intuitive platforms that can easily be leveraged across multiple departments to deliver the most ROI for the business and provide the actionable intelligence needed for effective risk management.

Turning to Innovation

In order to simplify, modernise and automate their security and business operations, financial institutions must implement integrated, end-to-end solutions across the enterprise that increase productivity and enhance risk management. At the core of such a solution should exist a video management system (VMS) that makes tasks easier for security personnel, ultimately saving on time while improving overall safety.

Video has long existed as a reliable method for capturing activity and it might seem obvious to state that it’s a critical piece of a bank’s security solution. But with the way that technology has evolved, we can now extract more data than ever before from today’s video management systems, which can lead to both numerous advantages and also an operational challenge. The influx of information must be streamlined, analysed and investigated by security operators in both a constructive and timely manner — a task that is often easier said than done without the proper VMS in place that provides the following benefits.

Simplified Access to Video

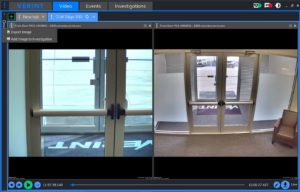

Bank security leaders and fraud investigators require advanced tools, such as video surveillance, to mitigate today’s most prevalent fraud schemes and risks. But sometimes it can be complicated to locate the video data necessary that allows them to pinpoint fraud and better identify anomalies. The ability to access video data in an accelerated manner can mean the difference between early fraud reduction and loss. A VMS platform with an intuitive interface can facilitate the ability to identify critical security data from multiple branches or locations in just a few clicks through easy-to-use controls.

Reduced Investigation Time

Fraud investigators face a myriad of cases at any given time and look to close them quickly to deliver value to the entire organisation. But with fewer resources and more risk scenarios, this is a significant challenge. Investment in powerful VMS is therefore paramount to enhance the investigations process and deliver the situational awareness banks require. With a system that is easy to use and navigate, users can access video quicker and therefore allow investigators to work more cases, which reduces fraud and increases the profitability of the bank.

Aligned Workflow

For financial institutions, ensuring accountability and increasing the efficiency of investigations is critical. With an advanced VMS platform that provides a modern, user-friendly design, these facilities can simplify operations through an interface that is aligned to the financial fraud and security investigator workflow. This then allows banks and credit unions to lower investigation thresholds, resulting in higher fraud recovery rates and customer satisfaction.

Reduction in Training Requirements

Oftentimes, banks have to invest in significant training to get new employees familiar with a software platform, which can hinder the overall performance and effectiveness of the facility’s security strategy. A straightforward VMS can enable new users to get up-to-speed and access live and recorded video in minutes, delivering ROI and cost savings to the organisation through fewer calls regarding system use.

Enhanced Collaboration

Tackling the substantial task of mitigating today’s risks takes more than just one stakeholder. Banks and credit unions can leverage VMS technology to share pertinent video data with other branches or facilities in the area looking to address the same concerns. Additionally, advanced VMS allows institutions to easily provide data to law enforcement agencies, reducing the time and effort required to investigate an incident and determine a resolution.

By empowering investigators to swiftly find the data they need, VMS platforms equip banks and credit unions with the tools necessary to ease the daily challenges fraud investigators face and eliminate threats and loss. Financial institutions can therefore do more with less, realising higher levels of intelligence and the rapid completion of tasks throughout the enterprise.

The Complete Picture

For financial institutions to stay one step ahead of today’s security threats, an efficient VMS must be one part of an overall greater solution designed to proactively pinpoint vulnerabilities and ensure immediate responses. Moving forward, banks must continue to prioritise leveraging multiples sources and sensors, including video, audio, social media, access control and more, to enable efficient data analysis and locate a potential risk before it becomes creates any damage.

By Alex Johnson, Senior Director, Analytics and Strategy, Verint